Online Marketing for Small Home Improvement Companies in a Bad Economy

If you run a business that provides home improvement related services, including services such as roofing, landscaping, well drilling, and so on, you're not alone in feeling the impact of slowed consumer spending. These industries were hit hard in 2024 and 2025. Other home improvement related companies across the country are facing the same challenges, as homeowners have cut back on renovation projects.

Below are just a few of many articles from 2024 and 2025 that highlight the decline in home improvement spending, and some that reiterate the need for continued (and even increased) marketing efforts. In fact, if you do a Google search for should I decrease marketing in a bad economy, you'll find plenty of results confirming that marketing should continue or increase during tough economic times.

Also

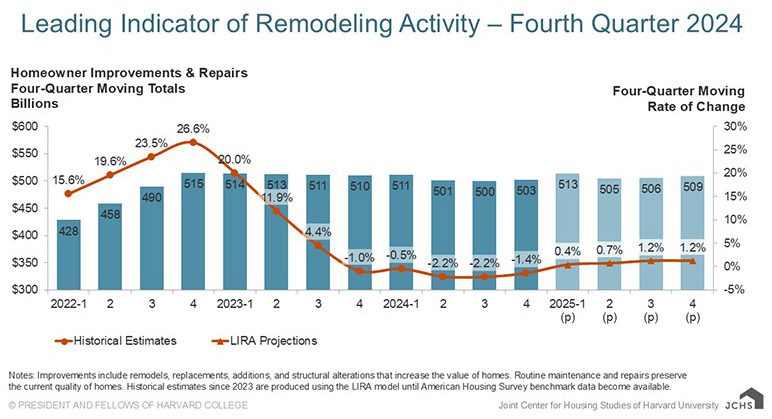

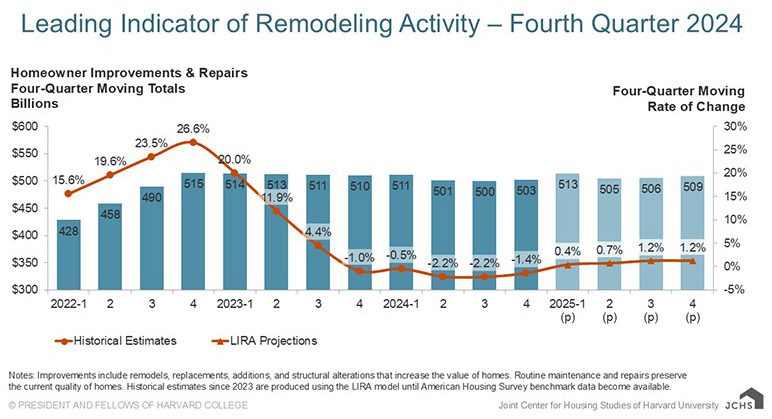

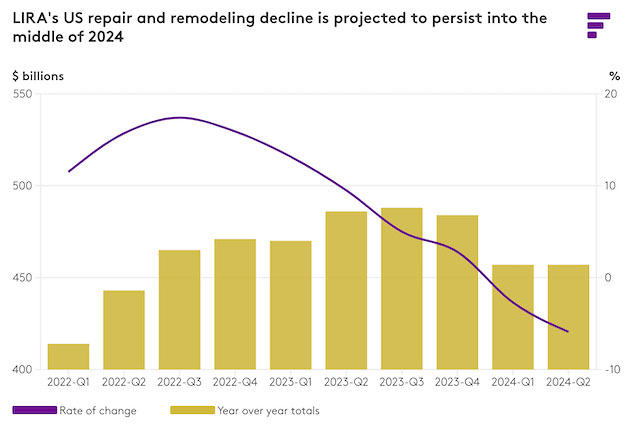

Look at that dip in remodeling spending in the charts below starting in 2023. In the first chart, the 2026 numbers are projected, showing that 2026 home improvement spending may continue to remain flat.

Google Search Ranking

- Where Is Your Website Ranking In Google?

- Google Search Ranking Factors

- Google Search Ranking Secrets

- Ranking for Multiple Services & Products

- Ranking for Multiple Cities and Counties

- Ranking on Page One of Google

- Is Your Website Search Friendly?

- What is Google Search Console?

- What is Google Analytics?

Websites

- How Much Does a Website Cost?

- How to Find a Good Web Designer

- Is Your Website Designed Properly?

- Reasons Why You Don't Want a Website

- Should I Get a WordPress Website?

- Is Your Website Outdated?

- Optimizing Website Images

- Wide or Panoramic Images on Website

- Is Your Text Really an Image?

- Website Page Speed & Search Ranking

- Email Contact Form

Domains and Hosting

- Domain Names and Web Hosting

- Lost Domain or Hosting Password

- Get Domain Back from Web Designer

- Domain Name Theft

- Domain Name Email Scams

Online Marketing

- Increase Marketing in a Bad Economy

- Home Improvement Spending Slowed

- How to Get Customer Reviews

- How to Handle Negative Reviews

- Thryv, Dex Media, DexYP and Hibu

- How to Cancel Thryv (Dex Media)

- Free Online Advertising

- Google Business Listing Scams